is car loan interest tax deductible 2019

10 x the number of days for which interest was payable. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later.

How To Claim Car Loan Tax Exemption Bank Of Baroda

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

. Heather determines the motor vehicle expenses she can deduct in her 2021 fiscal period. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. Business owners and self-employed individuals.

If a personal loan is being used for mixed purposes like a car loan with the car split between business and personal use then the portion of the interest thats deductible is proportional. However you can only deduct the amount attributable to business use. However if you use the car for both business and personal purposes you may deduct only the cost of its business use.

But there is one exception to this rule. More likely than not youll be planning to use your new vehicle for personal and business purposes. Your modified adjusted gross income is below 70000.

Typically deducting car loan interest is not allowed. When repaying student loans interest is tax deductible provided that you do not file separately while being married. 14 cents per mile.

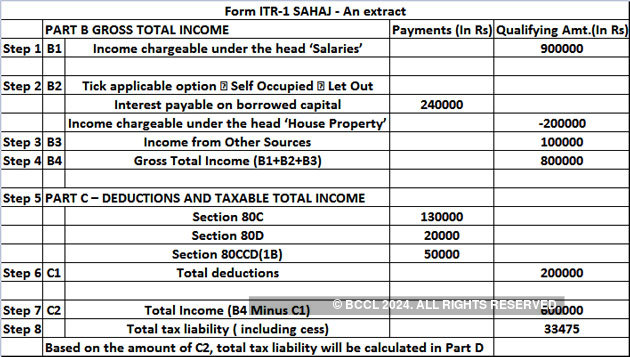

Taxpayers can also deduct parking fees and tolls in addition to the standard mileage rate. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be paid. Heather can deduct 5728 as motor vehicle expenses for her 2021 fiscal period.

17 cents per mile. Lantern by SoFi seeks to provide content. For example if you paid 1000 of interest on your car loan and used the vehicle 70 for business use and 30 for personal use you can deduct 700 on Schedule C.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. If you borrow to buy a car for personal use or to cover other personal expenses the. For vehicles purchased between December 31 1996 and January 1 2001 only.

14 cents per mile. At the page Based on the miles you drove choose Ill enter my actual expenses. Is Car Loan Interest Tax Deductible.

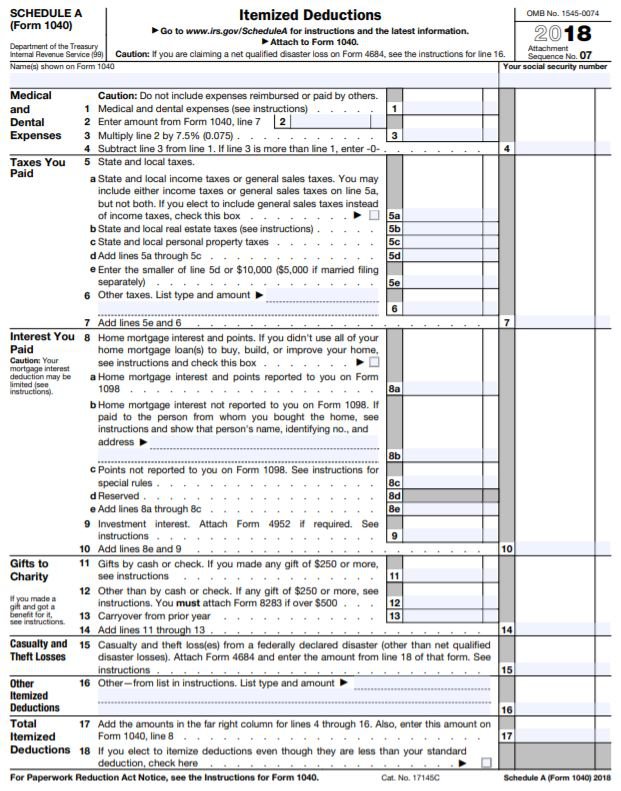

Some of these expenses include your payments of interest on a mortgage and for business loans. 20 cents per mile. You can generally figure the amount of your.

20000 business kilometres 25000 total kilometres 7160 5728. 16 cents per mile. If youre an employee vehicle expenses of any kind are not deductible even if you use your personal vehicle for business purposes due to the Tax Cuts and Jobs Act of 2017.

Experts agree that auto loan interest charges arent inherently deductible. 510 Business Use of Car. The IRS allows you to deduct certain expenses from your total income to arrive at taxable income which is the portion of your earnings that is subject to tax.

However when you use a credit card for personal purchases the interest you pay is nondeductible. Medical or moving. But you will need to keep accurate.

Click on Edit to the right of the business name. Buying a new car is a giant expenditure. In order to do this your vehicle needs to fit into one of these IRS categories.

Self-employed taxpayers may deduct car loan interest provided they deduct only that portion related to business use of the. If you use your car for business purposes you may be able to deduct actual vehicle expenses. February 16 2022.

1 Best answer. Self-Employed defined as a return with a Schedule CC-EZ tax form. To deduct interest on passenger vehicle loans take the lesser amount of either.

Interest on loan to buy vehicle 2200. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Usually the answer is no but there are exceptions.

14 cents per mile. Thus as the interest on car loan is allowed to be treated as an expense this reduces the income tax. Interest paid on personal loans is not tax deductible.

Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use. To the right of the vehicle click Edit. Under Your income click on EditAdd to the right of Self-employment income.

Yes the interest on your car loan is deductible even if you use the standard mileage rate. The IRS took that into consideration when they made the rules for deductions on cars you purchase for work. The deduction is based on the portion of mileage used for business.

If youre an independent contractor or small business owner looking to buy. Self-employed workers report motor vehicle expenses on the T2125 Statement of Business or Professional Activities form. You can also deduct interest on an auto loan registration and property tax fees and parking and tolls in addition to the standard mileage rate deduction as long as you can prove that they are business expenses.

To the right of the Vehicle expenses click Edit. 10 Interest on Car Loan 10 of Rs. If a taxpayer uses the car for both business and personal purposes the expenses must be split.

June 7 2019 301 PM. You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions. Can I deduct car loan interest deductions.

Read more about our Editorial Guidelines and How We Make MoneyDeducting auto loan interest on your income-tax return is not typica.

Home Loan Interest Tax Saving Clearance Sale Up To 54 Off Www Editorialelpirata Com

Section 24 Of Income Tax Act Deduction For Interest On Home Loan

Home Loan Interest Tax Saving Clearance Sale Up To 54 Off Www Editorialelpirata Com

5 Tax Deductions To Claim In Your Norwegian Tax Return

Are Health Insurance Premiums Tax Deductible Tax Refund Tax Deductions Second Hand Furniture Stores

Home Loan Interest Tax Saving Clearance Sale Up To 54 Off Www Editorialelpirata Com

Home Loan Interest Tax Saving Clearance Sale Up To 54 Off Www Editorialelpirata Com

Rental Property Deduction Checklist 21 Tax Deductions For Landlords In 2021 Being A Landlord Landlord Software Rental Property

Every Thing About Car Loan Tax Benefit Paysense Blog

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Home Loan Calculator Florida Home Loans Loan Calculator Loan

Personal Loan Tax Deduction Tax Benefit On Personal Loan Earlysalary

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Home Loan Interest Tax Saving Clearance Sale Up To 54 Off Www Editorialelpirata Com

Understanding The New 2019 Federal Income Tax Brackets Slabs And Rates Tax Brackets Federal Income Tax Income Tax Brackets

Car Loan Tax Benefits And How To Claim It Icici Bank

Are Personal Loans Tax Deductible Penfed Credit Union

Home Loan Interest Tax Saving Clearance Sale Up To 54 Off Www Editorialelpirata Com

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube